When you live in Japan and buy goods, a consumption tax is automatically imposed.

Since the tax is only a few tens or hundreds of yen for everyday purchases such as groceries, some people probably do not pay a lot of attention to it.

However, if you do business in Japan, you need be aware of the consumption tax. It is a very large amount of money that you may need to pay based on your annual sales.

This page explains the basics of the consumption tax system for businesses owners in Japan.

Basic Structure of the Consumption Tax

Consumption tax is a tax added on the price of goods and services in Japan, and is paid by business owners that sell the goods and services.

It is classified as an “indirect tax” because the person who bears the tax and the person who keeps it and pays it to tax office are different.

Consumption taxes have been adopted in many countries.

In Japan, it was introduced in April 1989.

The initial tax rate was 3%, but was changed to 5% in April 1997, 8% in April 2014, and 10% (8% in some cases) in October 2019.

The consumption tax is used not only for the national government, but also for local governments (prefectures and cities).

10% Consumption tax (Standard Rate) is distributed at a rate of 7.8% to the national government and 2.2% to local governments.

Exceptional transactions on which the consumption tax is not imposed

There are some transactions on which the consumption tax is not imposed. The following transactions are the examples.

- Transfer of land

- Interest from banks and other financial institutions

- Insurance premiums

- Subsidies, etc.

Reduced Rate

In principle, the consumption tax rate in Japan is 10%, but a “reduced tax rate” is applied to food and beverages, which are considered daily necessities, and the rate is 8%.

In addition, a newspaper subscription system that delivers a newspaper to the home or workplace each morning is widely used in Japan, and the consumption tax on the monthly newspaper fee in this case is also 8%.

Note: Some kinds of food and beverages and newspapers are not be subject to the reduced tax rate as below. In such case ,customers have to pay 10%.

<Examples of food and beverages subject to the exceptional 10% consumption tax and newspapers>

- Alcoholic beverages (non-alcoholic beer is subject to 8% consumption tax)

- Food served in a restaurant (8% consumption tax for takeout/delivery food)

- Pharmaceutical products

- Quasi-drugs (e.g. some vitamins and cosmetics)

- Newspapers sold in stores

Which businesses must pay consumption tax in Japan?

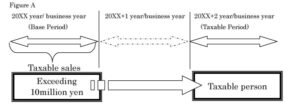

Businesses in Japan whose taxable sales exceed 10 million yen per year must pay consumption tax.

For sole proprietors, the tax filing period (from January 1 to December 31 of each year) is the Base Period for measuring whether “sales exceed 10 million yen per year.

If taxable sales for the base period exceed 10 million yen, then the company needs to pay consumption tax in the year after the next. So, if the taxable sales exceeds 10 million yen in 2020, “taxable period” will be 2022.

If taxable sales for the Base Period are less than 10 million yen, in principle, there is no obligation to pay consumption tax.

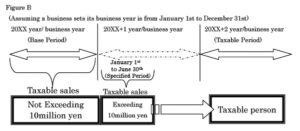

However, there are some exceptions.

If taxable sales exceed 10 million yen during the first half of the year following the base period (January 1 to June 30), the company may be obligated to pay consumption tax.

This first half of the year following the base period is called the “Specified Period.

Basically, even if annual taxable sales in the previous year did not exceed 10 million yen, business owners experiencing sudden jumps in sales should be aware of this.

This is because if sales exceed 10 million yen in the first half of the year, the taxable period may come in the following year.

Nevertheless, even if taxable sales for a Specified Period exceed 10 million yen, if the amount of salaries, etc., is 10 million yen or less, the company doesn’t need to pay consumption tax in the following year (they need to pay it in the year after the following).

On the other hand, if taxable sales exceed 10 million yen in the Specified Period and the amount of salaries, etc., exceeds 10 million yen, the company needs to pay consumption tax in the following year.

For example, if a venture company in the early stages of launch that is aggressively trying to achieve growth has taxable sales of more than 10 million yen for a Specified Period and pays more than 10 million yen for salaries, etc., it will be required to pay consumption tax in the following year.

In the case above, there is no long period until the consumption tax needs to be paid. We understand you want to reinvest your profits for your business, but you must never forget about the consumption tax.

To summarize the above story, here is what we have to say

(1) If taxable sales is over 10 million yen in the Base Period

→ Consumption tax will be imposed in the year after the next.

(2) If the amount is less than 10 million yen in the Base period and more than 10 million yen in the Specified Period

There are two patterns:

If the amount of salaries, etc., exceeds 10 million yen→ Consumption tax will be imposed in the following year.

If the amount of salaries, etc., is less than 10 million yen→ Consumption tax will not be imposed in the following year (it will be imposed in the year after the next).

(3) If taxable sales is 10 million yen or less in the Base Period and 10 million yen or less in the Specified Period

→ Consumption tax is not imposed.

Due to Invoice System to be introduced in November 2023, Some business owners will begin to pay consumption tax even if their taxable sales is less than 10 million yen for the purpose of issuing Qualified Invoice. For more details, please refer to our article about “Invoice System Japan“.

Summary

Japan’s consumption tax is 10% (or 8% with a reduced tax rate).

Some transactions, such as land sales, are not subject to the consumption tax.

The basic rule is that businesses must pay consumption tax in the year after the following year if their taxable sales exceed 10 million yen per year. However, there are a few exceptions to this rule. So you need to be aware of such exceptions.

If you find that you will be subject to consumption tax in the future, you must save a certain amount of money to prepare for paying the tax.

We have also prepared an article that explains in detail the two different calculation methods of consumption tax. Every business owner should check this article too.