To prepare for Japan’s new Invoice System which will come into force from October 2023, many companies and sole proprietors reluctantly registered as qualified invoice issuers.

But some of them may be wondering how to make a qualified invoice in accordance with the new regulation. Qualified Invoices need to describe following items:

- Name of a person or company who issues the invoice

- Name of person or company who receives the invoice

- Transaction date

- Transaction details

- Price of Transaction

- Registered Number as Qualified Invoice Issuer

- Indication of the transactions subject to 8% tax rate

- Indication of the transactions subject to 10% tax rate

- Total Price of transactions subject to 8% tax rate

- Total Price of transactions subject to 10% tax rate

- Total amount of consumption tax subject to 8% tax rate

- Total amount of consumption tax subject to 10% tax rate

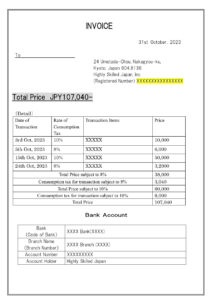

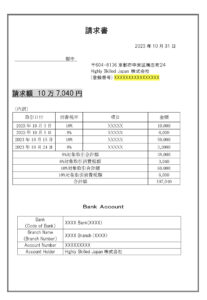

From item 1 to 5 are the same as before. Item 6 to 12 are newly added. So, we, Highly Skilled Japan, created samples of invoice which meets the requirements of the new system. Samples are created both in Japanese and English. We’ll explain how to make a Qualified Invoice by using this sample, one by one so that you can make your own invoice referring to our samples, English one or Japanese one.

Our Multilingual Sample of Qualified Invoice

For your understanding we made sample of invoice in English. But for business with Japanese partner, you may want to use Japanese version. So we created samples in both Japanese and English.

ENGLISH VERSION

JAPANESE VERSION

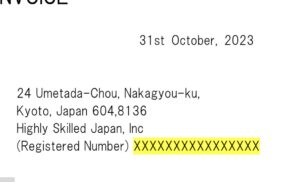

Registered Number as Qualified Invoice Issuer

All Invoice should show at least your name or your company’s name and name of person or company who receives your invoice. In addition, to make a Qualified Invoice, you need to describe your registered number as a Qualified Invoice Issuer. It is appropriate to put the number just under your name or your company’s name.

English Version

Japanese Version

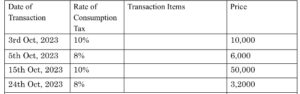

Indication of Consumption Tax Rate

In Japan, there are two consumption tax rates. The standard rate is 10% but the reduced rate, 8% applies to some transactions. Reduced tax rate (8%) applies to food and beverages, which are considered daily necessities. In addition, a newspaper subscription service that delivers a newspaper to the home or workplace each morning is widely used in Japan, and the consumption tax on monthly newspaper fee for such service is also subject to 8%. https://highly-skilled-japan.com/2023/02/15/2935/ Qualified Invoice should indicate which transactions are subject to 8% and which transactions are subject to 10%.

English Version

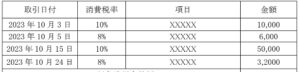

Japanese Version

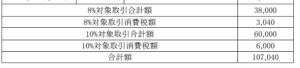

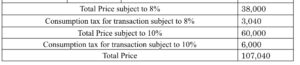

Total Amount of transaction subject to each rate

Qualified Invoice should also show total amount of transaction and consumption tax subject to each rate.

English version

Japanese Version