Filing a Tax Return (確定申告 Kakutei Shinkoku) is laborious and complicated task for everyone. Luckily, most of employees are released from the burden because your employers usually withhold your income tax and resident tax through the withholding tax system (源泉徴収 Gensen Choushu). And when employers withheld the tax too much from your salary, they will refund you the exceeding amount at the Year-End Tax Adjustment (年末調整 Nenmatsu Chousei).

However, there are some cases when employees can get an additional refund if you file a tax return yourself. So, in this article, we’ll explain the most typical cases when employees should voluntarily file a tax return to get the benefits.

Benefits of Tax Return in Japan

1. Medical Expense Deduction

When the annual medical expenses for your family exceed 100,000 yen or (5% of income if the annual income is less than 2 million yen), you can get Medical Tax Deduction (医療費控除 Iryou-hi Koujo). Medical expense such as costs for medical treatment, medicine, and transportation costs for hospital visits can be deducted.

2.Self-Medication Tax System

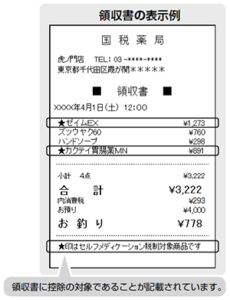

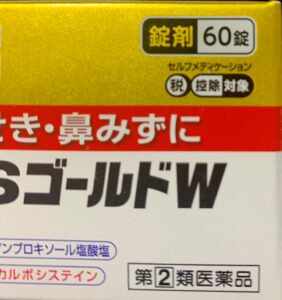

The self-medication tax system (セルフメディケーション税制) is a tax deduction where individuals who make certain efforts to maintain their health and prevent illness can receive an income deduction if the annual cost of designated drugs for the family exceeds 12,000 yen. The maximum deduction amount is 88,000 yen.

The requirement for this deduction is as follows:

- The Applicant appropriately pays income tax and residence tax;

- the Applicant has made certain efforts to maintain their health and prevent illness, such as Specific health checkup (so-called metabolic syndrome checkup), Vaccination, Regular health checkup or cancer screening; and

- The annual costs of designated OTC drugs for Applicant’s family exceeds 12,000 yen. Receipts and packages of drugs tells you which one is for self-medication tax system as below.

3. Housing Loan Deduction

If you take out a mortgage and your annual income is below 20 million yen, you should file a tax return for the first year of the loan term to get tax deduction called Housing Loan Deduction (住宅ローン減税 Jutaku Loan Genzei). From the second year, your company usually processes it for you at the Year-End Adjustment.

The amount of mortgage deduction is significant because 0.7% of the balance is deducted from income tax (the amount which cannot be deducted from income tax can be deducted from resident tax) for 10 to 13 years.

The Amount of tax deduction can be calculated according to the following formula.

Tax Deduction = Loan Balance (up to Maximum Loan Amount ) x Rate of Deduction.

Maximum Loan Amount varies depending on the type of your house and when you move into it.

Maximum Loan Amount for New House

Maximum Loan Amount for New house is as follows. For example, if you purchase long life quality housing in 2022 and moved into it within the year, the tax deduction will be 50 million yen×0.7% =350,000 yen even if your mortgage price is over 60 million yen. Tax can be deducted for 13 years.

| Start Living in 2022 | Start Living in 2023 | Start Living in 2024 | Start Living in 2022 | |

| Long Life Quality Housing or Low Carbon house. | 50 million yen | 50 million yen | 45 million yen | 45 million yen |

| ZEH Standards Energy Efficiency House | 45 million yen | 45 million yen | 35 million yen | 35 million yen |

| House meeting Energy Efficiency Standards | 40 million yen | 40 million yen | 30 million yen | 30 million yen |

| Others | 30 million yen | 30 million yen | 20 million yen

Only 10 years |

20 million yen

Only 10 years |

Maximum Loan Amount for Second Hand Housing

In the case of second hand housing, for certified house, maximum Loan amount is 30 million yen and for other houses 20 million yen( if you start living within the period from 2022 to 2025). The Deduction period is 10 years.

4. Hometown Tax Payment

Hometown Tax Payment (or ふるさと納税 Furusato Nozei) is not actually tax payment. It’s donation to the city or village where you don’t live. You can freely select a municipality to send money, and then the local specialties and products of the municipality will be given as 返礼品 “Returned Gifts” to you.

If you are interested in Hometown Tax Payment, please check our article about “Basic Knowledge about Furusato Nozei”

If you donate to 5 or less municipalities as Hometown Tax Payment(ふるさと納税 Furusato Nouzei), you can apply for the One-Stop Special Exception and you basically do not need to file a tax return.

What is One-Stop Special Exception?

If hometown tax is paid to not more than five municipalities, and an application is submitted for the special procedure system to each municipality receiving hometown tax, a taxpayer is eligible for a deduction for

donations from resident tax for the hometown tax without filing a tax return.

However, if you file a tax return for some reasons such as getting Medical Expenses Deduction or House Loan Deduction, you must declare a “Hometown Tax Payment” in the tax return because One Stop Special Exception do not apply to the case when you file a tax return. Of course, the person who fails to apply for One-Stop Special Exception also needs to file tax return.

5. Miscellaneous Loss Deduction

In case your asset that is normally needed for your daily life is damaged due to a natural disaster or theft, you may be able to apply for Miscellaneous Loss Deduction(雑損控除 Zasson Koujo). Since the calculation of the deductible amount is very complicated, you should consult with the tax office about this deduction.

6. When you resigned in the middle of a year

If you resigned from your company in the middle of the year and you failed to receive Year-End Adjustments, there is high chance you can get refund by filing tax return, because company may be withholding too much taxes (源泉徴収)on the assumption you will work for the company until the end of the year. And for the same reason, you should file a tax return in case you worked for a short period during a year and failed to receive Year-End Adjustment.

When to file tax return for refund

In the cases above, you can file tax return for refund within 5 years from 1st January of the following year. So you don’t have to wait until Feb 16th the beginning of mandatory tax return period. It’s good idea to finish the process earlier to avoid crowds in tax office.

The cases employees have to file a tax return

It is up to you whether you file a tax return for refund in each case discussed above. However there are some cases when employees are obliged to file a tax return. For example, person whose annual salary exceeds 20 million yen, person whose income other than salary exceeds 200,000 yen; or person who receives salary from 2 or more places (when income other than main income exceeds 200,000 yen) need to file a tax return. For more detail, please refer to the National Tax Agency’s page “Wage earners who must file a final tax return“.

How to get information about fling tax return

Although filing a tax return is painstaking and people tend to procrastinate it, the benefit can be big especially in case of House Loan Deduction. There is a guidance on how to file tax return issued by National Tax Agency. But reading this guidance is also hard work. So, our advice for you is to ask your tax account, Japanese friend or tax office about what documents are necessary to get the refund and bring all documents to the tax office in your city. The following telephone consultation services (in English) are also available. We hope our article make your life less taxing.

Tokyo 03-3821-9070

Nagoya 052-971-2059

Osaka 06-6941-5331

from 8:30 a.m.~5:00 p.m. (Only weekdays except national holidays)

Disclaimer this article has been updated on June 2022. Tax system is often changed. So it is vitally important to be aware of the current information.