Every year people living in Japan start talking about “Furusato Nozei” at some point during a year.

But you may have some questions like:

“I don’t really know what I am paying tax for?

“Why is this a hot topic?”

“Is it really beneficial?” .

To answer such questions, this page will explain what Furusato Nozei is and how you can get benefit by using it.

Furusato Nozei is not Nozei

Nozei means payment of tax but Furusato Nozei is not actually tax payment. It is donation to the city or village where you don’t live.

Under Furusato Nozei system, you can freely select a municipality to send money, and then the local specialties and products of the municipality will be given as 返礼品 “Returned Gifts” to you.

The main Returned Gifts are food stuffs such as meat, fish, vegetables, fruits, and alcoholic beverages. But many municipalities also offers a variety of other items, such as travel and accommodation coupons for famous sightseeing spots, beautiful traditional Japanese crafts, and rare folk crafts.

For the municipality, there is the advantage of receiving income from outside sources, and for the people living in Japan, there is the advantage of getting their favorite Returned Gifts.

You can easily select Returned Gifts and apply for online as if you were enjoying online shopping.

This ease of use is one of the reasons for the popularity of Furusato Nozei.

Tax benefit of Furusato Nozei

The amount paid as Furusato Nozei is deducted from the taxes.

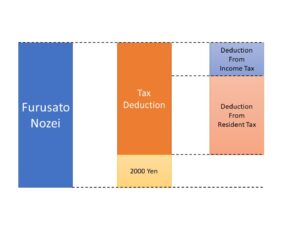

For more details, please refer to the following chart.

As the chart shows, the amount paid as Furusato Nozei, excluding 2,000 yen, will be deducted from the income tax of the current year and the resident tax of the following year.

So you could get various returned goods by only bearing the actual cost of 2000 yen.

It should be noted that there is an upper limit for the amount of Furusato Nozei. If you exceed the maximum amount, you will not be able to receive at least a portion of the above deductions and the actual tax burden will exceed 2,000 yen.

The maximum amount and deductions vary depending on your income and family structure, so please be careful in your calculations.

You can calculate maximum amount of Furusato Nozei by using the calculator offered by the following website.

https://www.furusato-tax.jp/about/simulation?top_left_pr

Process for Furusato Nozei

Application for Furusato Nozei can be completed online at the dedicated website operated by the municipality to which you wish to donate.

After an application is completed, you will receive a 寄付金受領証明書 “Certificate of Receipt of Donation”. This certificate is required in order to get deduction from your resident tax and income tax, so you must be careful not to lose it.

Generally, tax deductions for donations are made by filing a tax return with the tax office. However, the paperwork for filing a tax return is quite tedious. If you hire a tax accountant for this, you will have to pay him or her a fee and Furusato Nozei become no more beneficial after paying tax account fee for Furusato Nozei.

If you want to know about tax return in Japan, please refer to the article about Benefits of Tax Return in Japan.

For those who are not accustomed to filing tax returns, there is a system called “One-Stop Special Exception System,.

The One-Stop Special Exception System is a convenient system that allows taxpayers to receive tax deductions for Furusato Nozei without having to file a tax return after paying Furusato Nozei. Specifically, you can receive a deduction from your taxes by simply sending 寄附金税額控除に係る申告特例申請書 “Application for Special Exception for Donation Tax Deduction” to the municipality to which you donated.

However, the One-Stop Special Exception System is only available to those who donate to 5 or less municipalities in a year.

Also, those who are required to file a tax return for reasons other than Furusato Nozei are not eligible to use this system.

For example, those who are self-employed, those whose salary exceeds 20 million yen, and those who are required to file a tax return for medical expense deductions, Home Loan Deduction etc., must file a tax return to claim tax deductions for Furusato Nozei, not the One-Stop Special Exception System.