Who needs to pay inheritance tax in Japan?

Many people have questions about Japanese inheritance tax.

I’m currently living in Japan, if my American father, who lives in the U.S., dies and I inherit his properties located in the U.S and Japan, am I liable to pay inheritance tax in Japan?

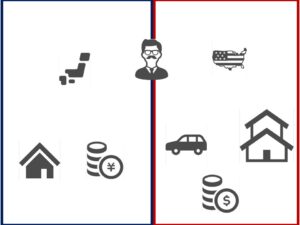

Expat’s obligations for inheritance tax can be changed depending on their status of residence and whether or not they have been domiciled in Japan for longer than 10 years during the 15 years before the commencement of succession.

For example, holders of the status of residence such as spouse visa or permanent residence are taxed on inherited properties located all over the world regardless of the period they have lived in Japan.

On the other hand, holders of working visa such as Engineer visa are taxed only on the inherited properties located in Japan unless they had an address in Japan for longer than 10 years during the 15 years prior to the commencement of succession.

I have an engineer visa and have been in Japan for 8 years. It seems I should go out of Japan before 10 years have passed.

For more detail, please check the website of National Tax Agency.

Inheritance Tax Rate

I’m kidding. But I heard Japanese inheritance tax is very expensive. Is it true?

As the chart below shows, the highest inheritance tax rate in Japan is 55%, which is quite high. In reality, however, the amount of the basic deduction and the calculation method of inheritance tax differ from country to country.

Therefore, Japanese inheritance tax is not always higher than that of other countries. And, of course if the value of inherited properties is less than Basic Deduction(We’ll explain about this deduction below), you don’t have to warry about it.

| Taxed Value | Tax Rate | Deduction |

| 10 million yen or less | 10% | |

| 30 million yen or less | 15% | -500,000 yen |

| 50 million yen or less | 20% | -2 million yen |

| 100 million yen or less | 30% | -7 million yen |

| 200 million yen or less | 40% | -17 million yen |

| 300 million yen or less | 45% | -27 million yen |

| 600 million yen or less | 50% | -42 million yen |

| Over 600 million yen | 55% | -72 million yen |

Calculation of Inheritance Tax in Japan

Example of Calculation

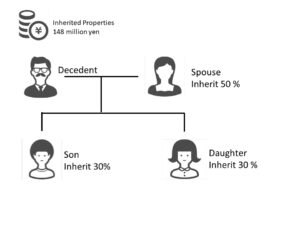

Here, there is a family of husband, wife and two children.

One day, the husband died leaving a fortune of 148 million yen.

Then, wife and children agreed that wife would inherit 50 % of inherited properties and son would inherit 30% and daughter would inherit 20%.

Let’s look at how Japanese inheritance tax can be calculated in this case.

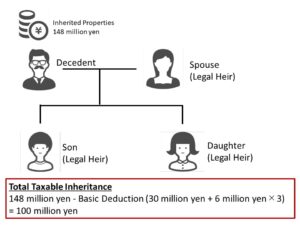

Step 1 Calculation of Total Taxable Inheritance

Firstly, you need to calculate Total Taxable Inheritance by subtracting Basic Deduction from Inherited Properties.

Basic Deduction can be calculated by the following formula.

Basic deduction = 30 million yen + 6 million yen x number of legal heirs

In this case, there are 3 legal heirs (wife, son and daughter). So, total taxable inheritance is 100 million yen (=148 million – 30 million – 6million x 3).

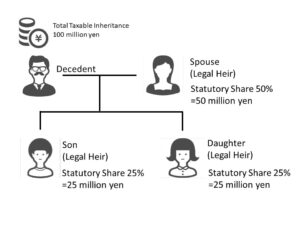

Step 2 Calculation of Total amount of inheritance tax

Secondly, you need to calculate total amount of inheritance tax.

This calculation is a little tricky. Because in order to calculate total amount of inheritance tax, you need to once assume that each party inherited the properties according to Statutory Share in Inheritance set forth in Japanese Civil Code, despite the actual inheritance ratio.

In this family case, wife’s Statutory Share in Inheritance is 50% and son and daughter’s share is 25% each. So, it is assumed that wife inherited 50 million yen (a half of 100 million yen) and each of children inherited 25 million yen (25% of 100 million yen).

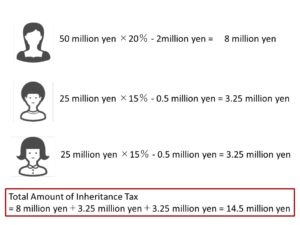

Based on this assumption, inheritance tax to be imposed on the wife is 8 million yen (=50 million yen x 20% – 2 million yen), while Inheritance tax to be imposed on each of the children is 3.25 million yen (=25 million yen x 15% – 500,000 yen).

| Tax Rate | Deduction | |

| 10 million yen or less | 10% | |

| 30 million yen or less | 15% | -500,000 yen |

| 50 million yen or less | 20% | -2 million yen |

Total amount of inheritance tax can be calculated by adding up the inheritance taxes of each heir. So it is 14.5 million yen (8million yen + 3.25 million yen x 2).

Step 3 Calculation of Actual Amount of Inheritance Tax

Finally, you can calculate Actual Amount of Inheritance tax to be imposed on each heir by dividing the total amount of inheritance tax according to the actual ratio of succession.

As described above, wife and two children agreed that wife would inherit 50%, son would inherit 30 % and daughter would inherit 20%.

So, inheritance tax amount which each heir actually need to pay is:

Wife: 14.5 million yen × 50% = 7.25 million yen. (→ 0 yen)

Son: 14.5 million yen × 30% = 4.35 million yen.

Daughter: 14.5 million yen × 20% = 2.9 million yen.

On the contrary to the calculation above, wife does not need to pay Japanese inheritance tax in this case because there is a tax exemption for spouse up to the Statutory Share in Inheritance or 160 million yen, whichever is greater.

What is the foreign tax exemption?

The fact you need to file inheritance tax both in your home country and Japan doesn’t mean you need to pay double tax. You may be able to use foreign tax exemption. The foreign tax exemption is a mechanism to deduct some or all part of the tax paid in a foreign country for the same subject from the amount of tax due in Japan.

Generally speaking, this exemption is available if you inherit properties located in a country other than Japan and you have paid a tax equivalent to inheritance tax in the country.

It is advisable to consult with a tax accountant who has experience in international taxation to confirm whether a foreign tax exemption is available or not, and if it is available, what kind of documents are necessary to use it.